Lump sum lifetime mortgage vs drawdown lifetime mortgage

Lump sum lifetime mortgage

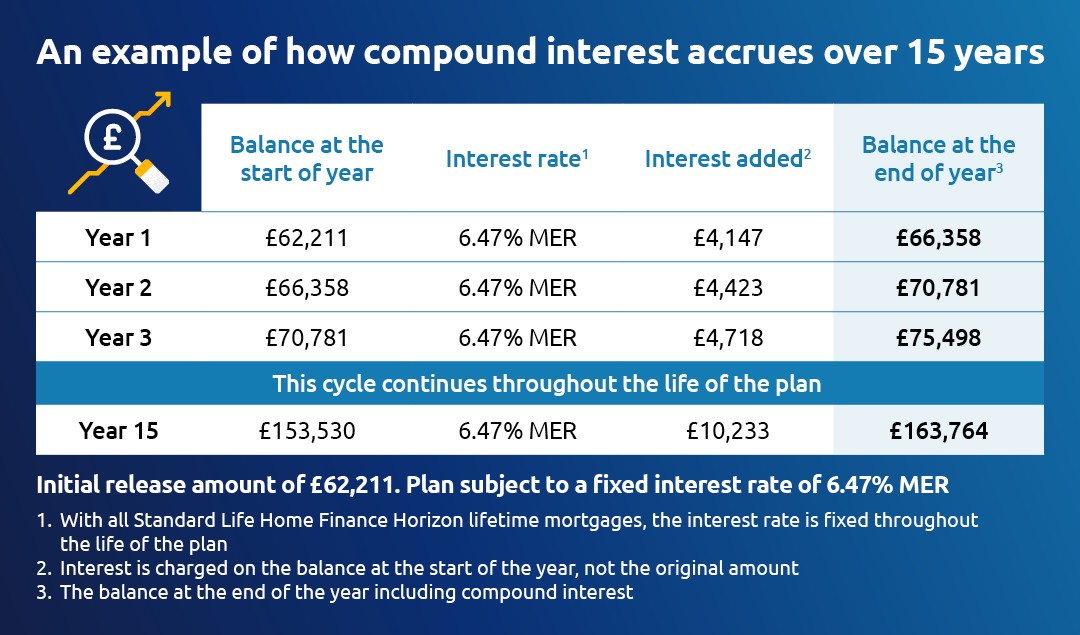

A lump sum lifetime mortgage is where you receive all the money you release in one go and there are typically no monthly repayments to make unless you choose to as the loan, plus compound interest, is typically repaid through the sale of the property when the last remaining applicant passes away or moves into long-term care. Alternatively, if you opt for a Horizon Interest Reward lifetime mortgage, monthly interest payments are required for an agreed term of 5, 10 or 15 years in order to obtain a discounted interest rate.

With our lifetime mortgages you could release from £15,000 to £1.5 million, depending on your personal circumstances.

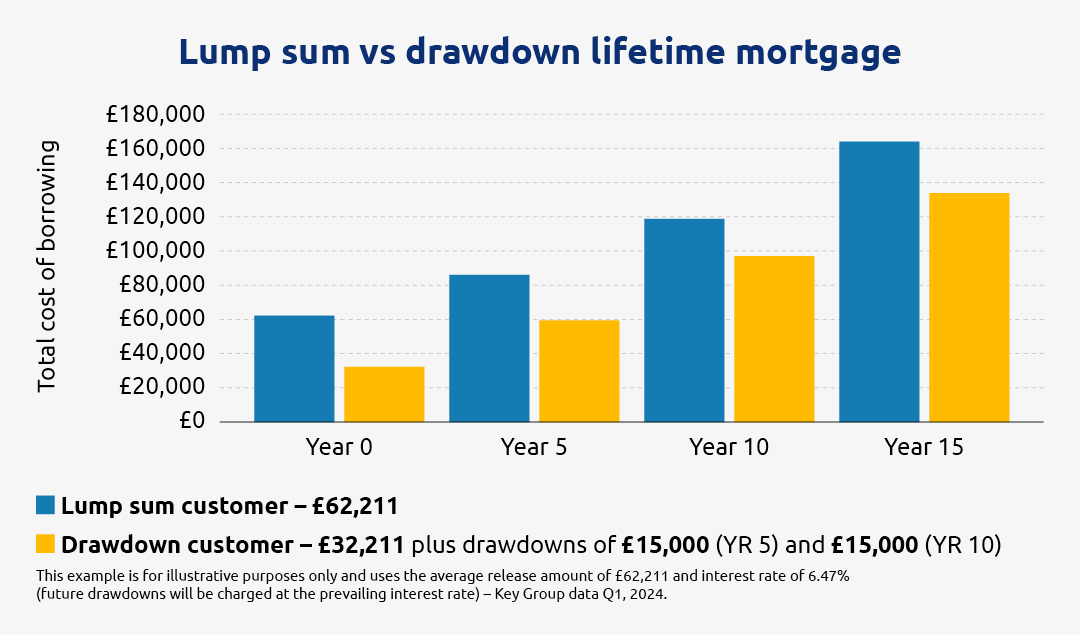

When you complete your lifetime mortgage, you’ll receive all your tax-free cash in a single lump sum. This can be ideal if you have several expenses to cover at once, such as repaying an existing mortgage, gifting to a family member and home improvements. A lump sum lifetime mortgage could cost more over time as interest is applied to the full release amount from day one.

Drawdown lifetime mortgage

With a drawdown lifetime mortgage, you still get access to tax-free money and again there are typically no monthly repayments to make unless you choose to.

However, instead of receiving your funds in one lump sum, you can take the money as and when you need it following an initial release of at least £15,000.

This could be suited to you if you don’t need all your money upfront and want access to cash later down the line. It could also work out cheaper – as you only pay interest on the money you release and at the time you receive it, meaning you’re not paying interest on cash you don’t need.

It’s worth noting, though, that the interest rate applied to any drawdowns you make will be the prevailing rate at the time, not the rate you initially secured. A drawdown facility is not guaranteed as the lender has the right to withdraw it.

Reducing your cost of borrowing

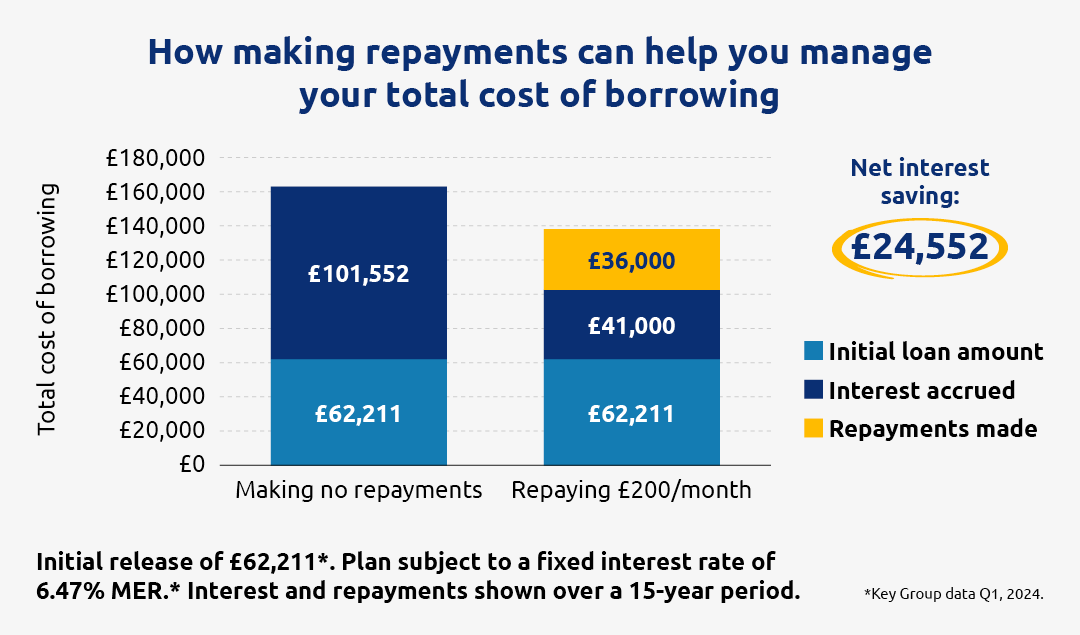

Making ad-hoc or regular repayments

With all Standard Life Home Finance's Horizon lifetime mortgages, you have the option to make repayments, if you wish, without incurring early repayment charges, subject to criteria. We recommend that this is discussed with your equity release adviser to understand what would deliver the best outcome for your existing circumstances and future needs.

Considering a drawdown lifetime mortgage

Horizon Interest Reward

It’s important to discuss this with your equity release adviser and consider your affordability to make payments.

Getting the right advice

If you are considering a lifetime mortgage, it is a Financial Conduct Authority regulation that you first seek advice from a qualified equity release adviser, who will help you understand your options and advise on what is right for you.

All Equity Release Council members agree to abide by Equity Release Council rules, guidance and standards, and have signed up to the Council's Statement of Principles. When finding your equity release adviser, you can search the Equity Release Council's database of registered equity release adviser members.